|

| Simon Thompson opens the Sunday Business Summit |

Sunday, July 13

Business Summit Highlights

Jon Voorhees, SVP of Retail

Distribution at Bank of America - and an old RPM friend and Northridge colleague - gave one of the most informative,

entertaining, actionable, and data-centric presentations ever given at the

Summit (OK, so he's our pal, so what.). Jon leads the retail

distribution execution team at B of A, where he’s responsible for the execution

of all retail distribution programs impacting nearly 9,000 banking center and

ATM locations. Jon’s group consists of

about 100 users nationwide, predominantly working from home to help re-configure

branch network locations and sites.

|

| Jon suggests what branches will become |

Flagship. Each of the Bank’s Top 15 markets will have a

Flagship branch, a contemporary full service approach staffed with full time

specialists.

Enhanced Banking Centers. These branches will have 2 or more specialist

full-time, but will also feature and rely on a good deal of digitally delivered

content.

Standard Banking

Centers. These are the traditional

branches, with specialist coverage defined by market needs and usage.

Express Centers. The Express Centers will have no tellers –

transactions will be strictly automated, allowing the branch to concentrate on

sales and service, again fine-tuned to the market.

Remote ATMs and ATAs. The Bank appears to be among the most

successful at placing off-premise machines, and adding ATM assist technology

that incorporates Teller-on-Demand, including the ability to be served

on-demand in Spanish.

Jon also discussed some of the innovations inside, like Teller

Assist – and the Bank’s successes with reconfiguring branches.

|

| Carlous had great slides! |

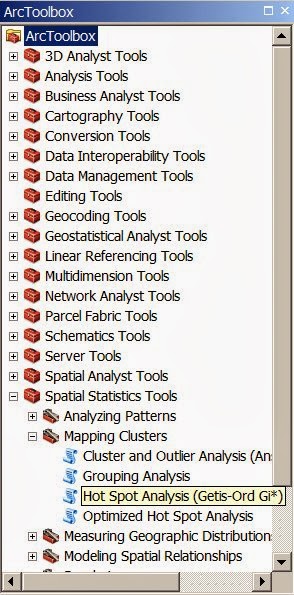

In fact, Carlous mentioned spatial analysis as a key

underpinning of most everything that the Bank is doing. As an underpinning to strategic distribution

planning, he described “Controllable” (where are our current and prospective

locations, where are we saturated, etc.) and “Non Controllable” factors

(demography, regulatory, etc.), and described in detail all of the key data

inputs to distribution strategy.

- Site-Specific, such as location, usage, profitability

- Demographics, block group stats on population, growth, daytime population, income

- Customer locations, stripped of personal identifiers in the GIS

- Regulatory – low and moderate income and minority designated areas

- Competition – location, deposits, open date

- Retail – shopping center and key retailer locations

- Physical geography – streets, railroads, water features, topography, etc.

Carlous also described how seminal GIS has become to

virtually everything the Bank plans and does, supporting all of the following

processes:

- Market investment prioritization

- Branch & remote ATM planning

- Regulatory compliance

- New branch forecasting

- Customer spotting

- Attrition-retention modeling

- M&A analysis

- Risk mitigation

- Asset management

- Logistics

- Real estate appraisal

- Commercial RFP response

- Investor relations

Even before the Plenary began, RPM’s new Unbanked map and dataset from the new Living Atlas of the World was prominently featured as one of the slides on the giant central screen, one of 7 positioned for viewing by the some 16,000 folks in attendance.

Esri has already made the Plenary videos available, and you can find them all at

ArcGIS Pro. The brand-new, Excel-like ArcGIS Pro will ultimately

be the replacement for the ArcGIS Desktop.

It’s 64 bit, and multithreaded, so it will be much faster, even when you

have other apps open (like Office). Pro

also features the ability to save multiple layouts of a single map, so there

will be no more proliferation of weighty project files when all you want is a

layout. Labeling is much easier, and

better exposed in the ribbon menu. There

is also much better management of the structure and format of tables. All in all, Pro is really what we’ve wanted

all along as business users. Something

that looks and works just like Excel.

GeoPlanner. GeoPlanner is a new ArcGIS extension that

offers a slider-based, very easy-to-use approach to geodesign, providing tools

that support all the steps of land-based planning, featuring a complete

geo-enabled design workflow that is browser-based. We’re very excited at the

possibilities of geodesign in banking.

For example, a bank could use GeoPlanner to implement strategy and designate which

of several types of “branches of the future” each of their current branches

will be, based on geodesign – basing the type of branch on its geographic

location, the site, and the land use and land characteristics. In other words, GeoPlanner allows us to

specify thresholds for business opportunity, savings v borrowing v transaction

business, key demographics, urbanicity, share of wallet etc. to define what

branch type will be carved from the former branch structures, dominated by the oversized

full service branches configured to do the business of the 20th, not

21st century.

Remembering Roger

Tomlinson

Roger Tomlinson, an Officer of the Order of Canada, was the father of GIS, and a mentor to many of us. Roger passed away in February, and was memorialized at the conclusion of the Plenary and in a special memorial area at the UC.

Roger’s patience and encouragement of adults and kids alike who are brand new to GIS is legendary. It's an example for us all, as we seek to make GIS more valuable for our companies and clients, internal and ultimate employees, and customers, communities and neighborhoods.

Roger Tomlinson, an Officer of the Order of Canada, was the father of GIS, and a mentor to many of us. Roger passed away in February, and was memorialized at the conclusion of the Plenary and in a special memorial area at the UC.

Roger’s patience and encouragement of adults and kids alike who are brand new to GIS is legendary. It's an example for us all, as we seek to make GIS more valuable for our companies and clients, internal and ultimate employees, and customers, communities and neighborhoods.

The memorial featured this note of thanks to Roger, from a

person who herself is now a GIS leader.

“When we met Roger for the first time, he listened, he encouraged, and he advised us, patiently guiding even a GIS beginner like myself.”

For me, Roger was a personal friend, who knew a little bit about and cared about me, and my family. He was one of the greatest men I ever knew, and would be even if he never made a single map. "If you must worry, worry about what you're giving back." Roger's impact on me, on Jack Dangermond and Esri, and upon the world can't even be estimated.

Tuesday, July 15 UC and Business Summit Highlights

The Summit concluded on Tuesday during the broader UC, marking the 4th

day of content relevant and/or dedicated to business geography.

Featured were a session from the Milken Institute on Payday Lending, and another presentation from Carlous Brown about GIS and retail delivery and strategy. (I also should mention that among his credentials is a background in Earth Science, which is pretty cool for a corporate planner. Jon's original CSUN degree was in Economic Geography, that was prescient, too).

Featured were a session from the Milken Institute on Payday Lending, and another presentation from Carlous Brown about GIS and retail delivery and strategy. (I also should mention that among his credentials is a background in Earth Science, which is pretty cool for a corporate planner. Jon's original CSUN degree was in Economic Geography, that was prescient, too

Later that afternoon, the first formal Esri banking SIG convened with 86 of us in attendance, facilitated by Matt Perry and Lauri Young of Esri who did a great job of putting this together and presenting. Conducting a live, smartphone-based interactive poll, Matt surfaced a series of questions about the adoption process and usage of GIS technology in banking.

·

The opportunity to support a big-money, high

visibility, C-level decision with GIS and data science was what got several of

the major banks started with GIS.

- But, many of those who attended did not yet have C-level exposure for their GIS investment. Typically, the CFO; the CMO; or the CAO are the ones pestering their CIO to step up to GIS to solve that initial big money problem.

- The typical GIS department of a large bank features 5-6 GIS power users who may be extending and distributing their work to as many as 100 distributed users, very typically using portal technology, for reasons of security, to provide AGOL and BAO and private BAO lightweight access.

- Currently, no one was delivering web maps via a smartphone or mobile device, though some are planning this in as soon as 3 months.

- When asked what kinds of data it would be most valuable for GIS to bundle with banking solutions (photo above), FDIC or branch location and deposit data; traffic data; retail and shopping center location data; and consumer segmentation and financial services potential data were among the most desired.

Conclusion

One of the most successful

Business Summits was empowered by the great efforts of Simon Thompson and the Esri

team, reflecting months of work and planning.

We had a real breakthrough in the Banking SIG, which we hope will flower now among more banks and credit unions, along with what has largely been the RPM, industry association, research and consulting communities.

And the best road map, daunting as it may be, came from Bank of America. It was great fun to have senior planners from the Bank who are also geo-geeks. And, during the SIG meeting, to have multiple GIS staff from Wells Fargo, and J.P, Morgan Chase, and several others, all in the same room, discussing maps and GIS and how to become more helpful - visible, and valuable - to our companies.

We had a real breakthrough in the Banking SIG, which we hope will flower now among more banks and credit unions, along with what has largely been the RPM, industry association, research and consulting communities.

And the best road map, daunting as it may be, came from Bank of America. It was great fun to have senior planners from the Bank who are also geo-geeks. And, during the SIG meeting, to have multiple GIS staff from Wells Fargo, and J.P, Morgan Chase, and several others, all in the same room, discussing maps and GIS and how to become more helpful - visible, and valuable - to our companies.